PERSONAL UMBRELLA AND EXCESS LIABILITY INSURANCE

SPECIALTY INSURANCE SOLUTIONS FOR CLIENTS WITH COMPLEX LIABILITY EXPOSURES

Having multiple properties, a teen driver in the household, or unique assets, like a hobby farm, are just some factors that increase clients’ exposure to a major claim and losses that greatly exceed underlying policy limits. DeCotis Specialty Insurance helps agents secure Personal Umbrella and Excess Liability options from AM Best A-Rated markets offering the additional financial protection clients require.

Target Classes

FOR CLIENTS REQUIRING ADDITIONAL LIABILITY COVERAGE

We provide our agency partners access to tailored Personal Umbrella and Excess Liability options for clients and their properties, including but not limited to:

- Clients with up to 20 residential locations, 10 vehicles, and six watercrafts

- Owner- or tenant-occupied homes

- Condominiums, co-ops, duplexes, and triplexes

- Homes owned by trusts, LLCs, LPs, and estates

- Hobby farms

- Vacant land

Product Highlights

To read more product highlights, please download and save the coverage sheet.

- Primary and Excess Umbrella policies up to $10 million

- Drivers up to 85 years old acceptable

- Uninsured Motorist Coverage up to the liability limit

- Identity Theft Unlimited Restorative Coverage for 12 months

- Personal Cyber Liability endorsement available

SUBMISSION REQUIREMENTS

Download a Personal Umbrella Application and provide any additional relevant information. Send the application to: Quotes@DeCotis.com.

GETTING A PERSONAL UMBRELLA AND EXCESS LIABILITY QUOTE IS SIMPLE

Select one of the following options to request a quote for your clients’ specialty insurance needs:

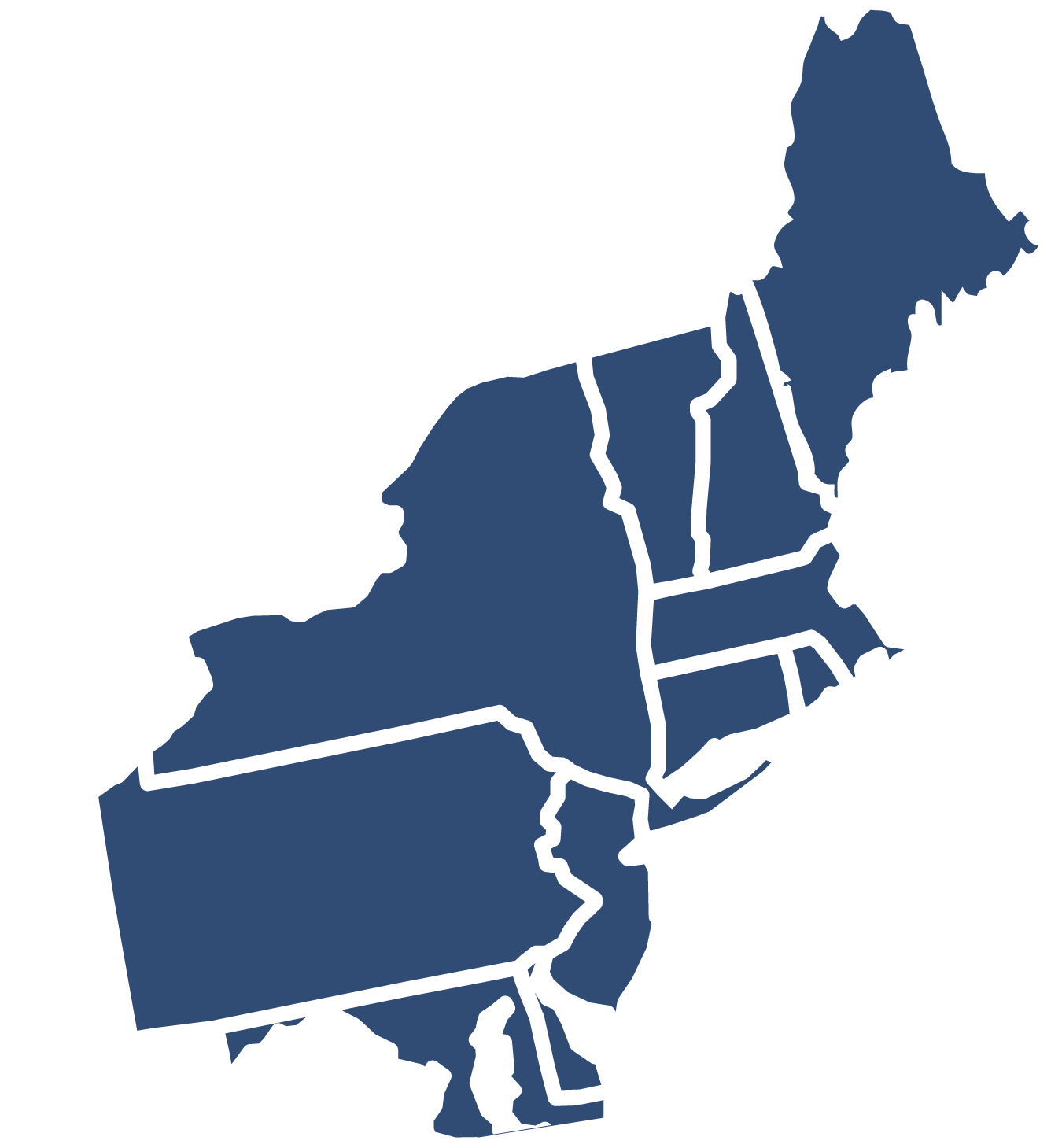

States where

we do business

States where we do business

- Connecticut

- Delaware

- Maine

- Maryland

- Massachusetts

- New Hampshire

- New Jersey

- New York

- Pennsylvania

- Rhode Island

- Vermont

- District of Columbia

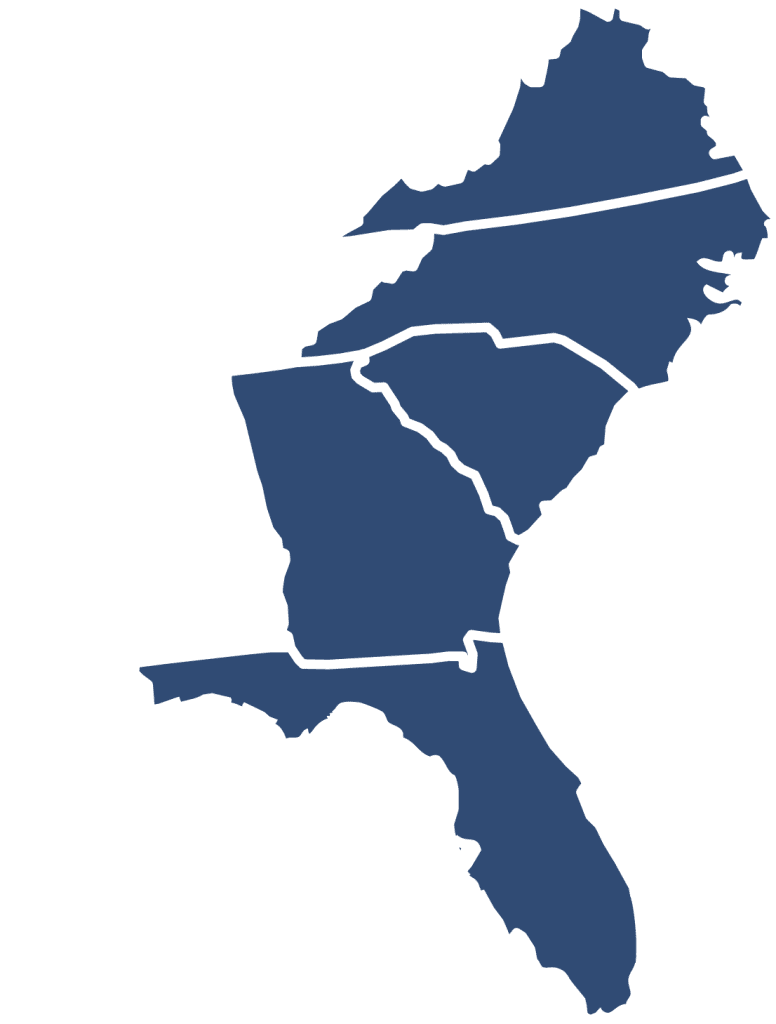

- Florida

- Georgia

- North Carolina

- South Carolina

- Virginia

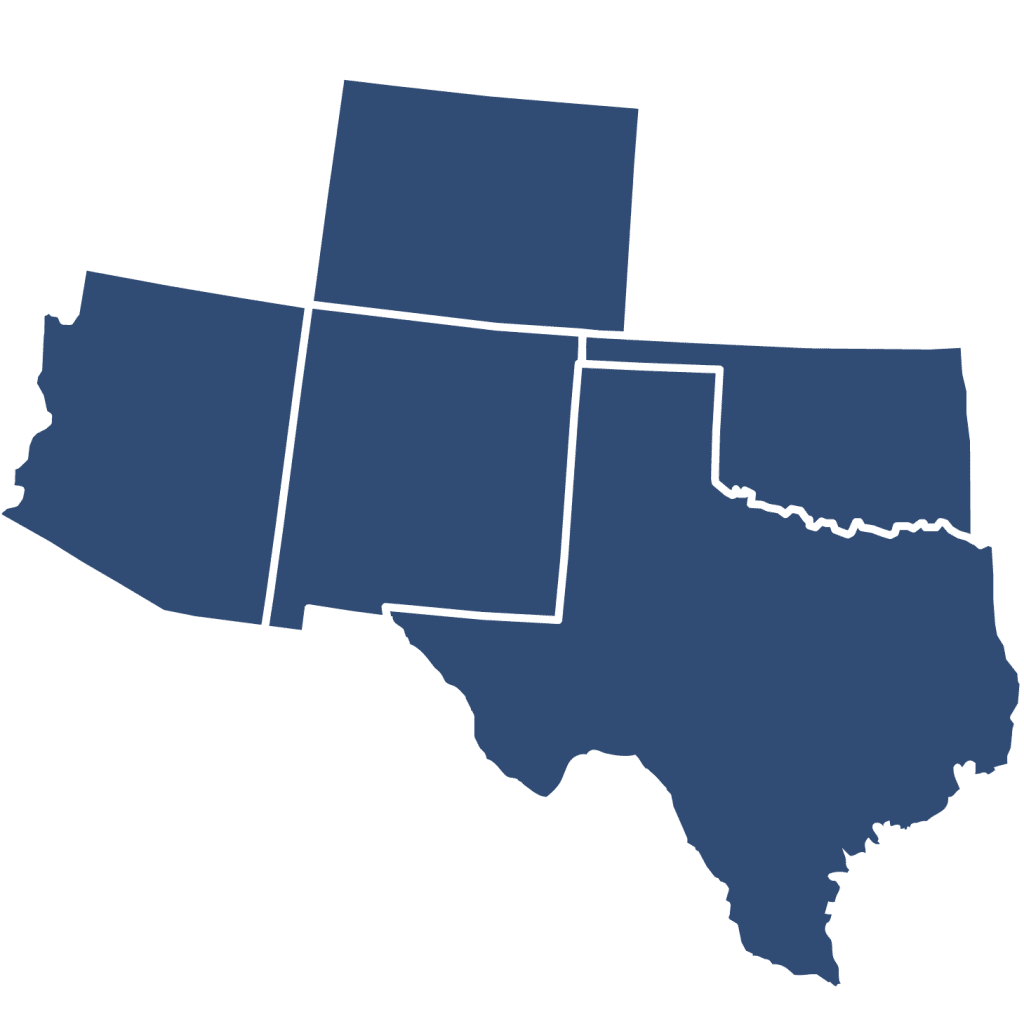

- Arizona

- Colorado

- New Mexico

- Oklahoma

- Texas

CROSS-SELL OPPORTUNITIES FOR SURPLUS LINES

Your clients may also require these products.

Home Insurance

Designed to help homeowners pay to repair, replace, or restore their house, belongings, or other structures on their property that are damaged as a result of a covered event.

Personal Liability Insurance

Provides additional financial protection to property owners and individuals who require higher liability limits than primary policies provide due to an increased exposure to costly claims and lawsuits.

Does DeCotis Deliver? Hear From Our Agency Partners.

THE POWER OF CHOOSING DECOTIS

- Responsive Support from Experienced Underwriters

- Access to AM Best A-Rated E&S Carriers

- Coverage for Standard and Hard-to-Place Risks

- Flexible Options for Clients That Need Higher Liability Limits