homeowners insurance

SPECIALTY INSURANCE TAILORED FOR YOUR CLIENTS’ DISTINCT RESIDENTIAL PROPERTY RISKS

Finding reasonably priced, comprehensive homeowners coverage for coastal properties, high-value and historic homes, short-term rentals, and similar risks can be difficult in the standard market today. With in-house binding authority and access to multiple Lloyd’s markets, DeCotis Specialty Insurance offers a fast and easy alternative to agents looking for customizable Primary and Excess Home Insurance options for clients with complex risks.

Target Classes

FOR PRIMARY AND EXCESS HOMEOWNERS

We provide our agency partners with access to Home Insurance options for a wide range of property types and ownership structures including but not limited to:

- Primary, secondary, and seasonal homes

- 1-4 family homes

- Annual and short-term rentals

- Vacant properties

- Homes under construction (Builders Risk)

- Spec homes

- Condominium units

- Homes owned by trusts, estates, LLCs, or LPs

Coverage Options

DeCotis offers various surplus lines solutions to help agents meet the needs of residential property owners.

- Primary HO-3, HO-5, HO-6, DP-3

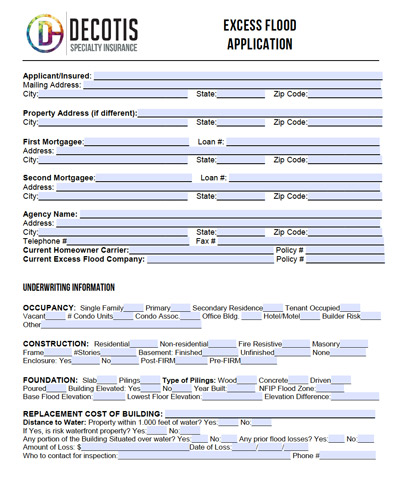

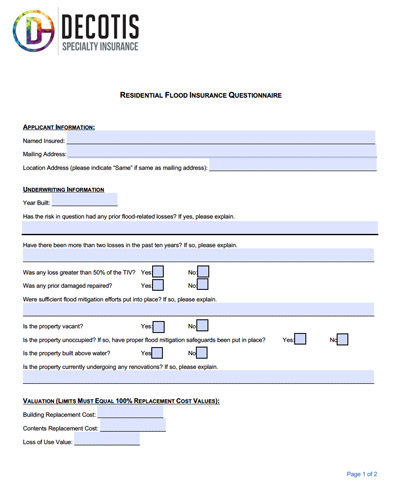

- Primary and Excess Flood

- Excess Wind and Wind Deductible Buyback

- Earthquake Coverage

EXCESS HOMEOWNERS COVERAGE

- Limits up to $10 million over $1 million Coverage A

- 1-4 family homes

- Primary, secondary, seasonal, and rental homes

- Historic homes, hobby farms, mansions, and waterfront homes considered

- Follow Form policy

- Minimum premium: $750

Product Highlights

To read more product highlights, please download and save the coverage sheet.

- No supporting business required

- Coastal locations acceptable

- Primary limits up to $20 million total insurable value (TIV)

- Excess Property capacity up to $10 million

- Wind deductibles from 2% up to 5% available

- Ability to package Excess Flood and Scheduled Personal Property with Homeowners policies

- Monoline Wind and Earthquake policies available

- Customizable B, C, and D Coverage options, so clients only pay for what they need

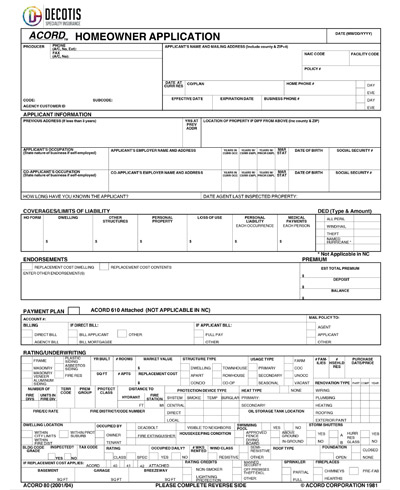

SUBMISSION REQUIREMENTS

Download the application that best suits your clients’ needs and any additional relevant information. Send the application to: Quotes@DeCotis.com.

GETTING A HOME INSURANCE QUOTE IS SIMPLE

Select one of the following options to request a quote for your clients’ specialty insurance needs:

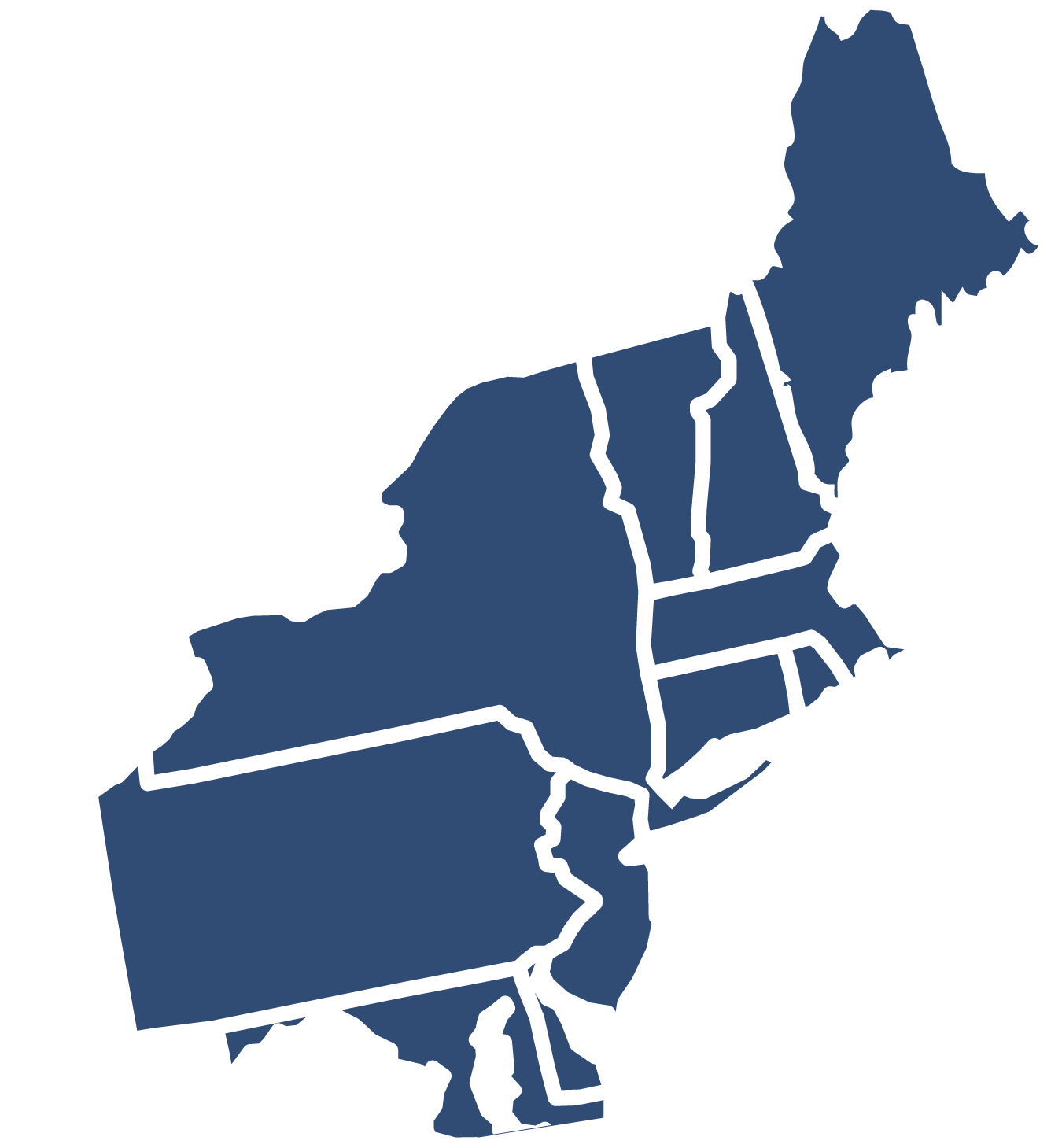

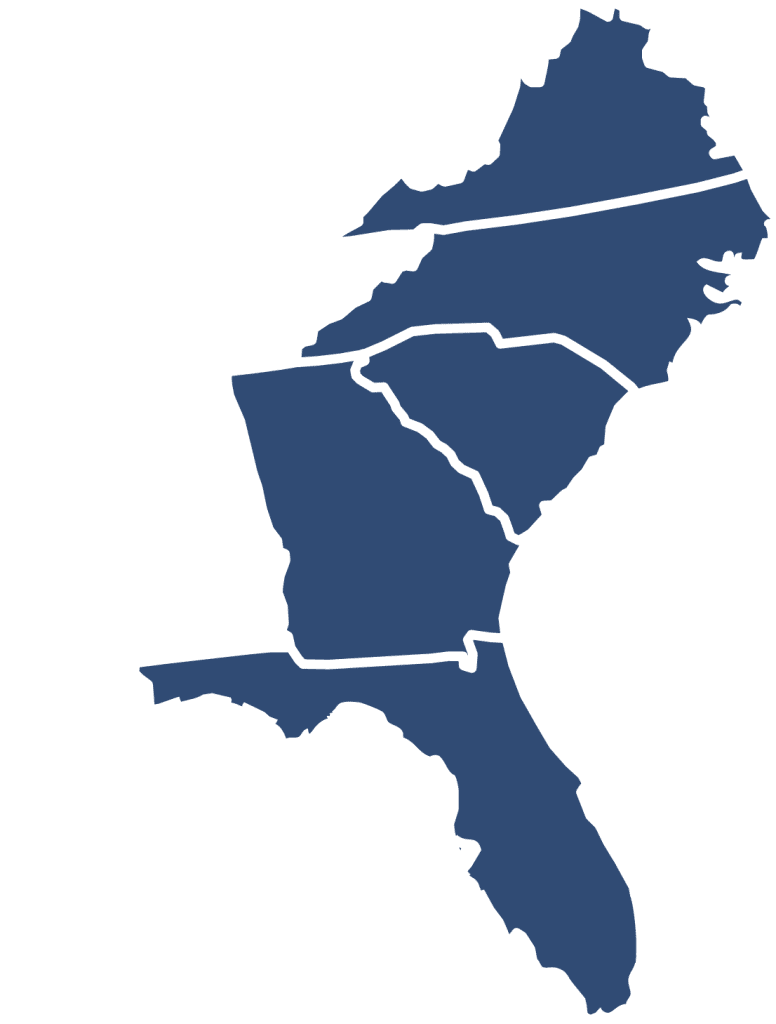

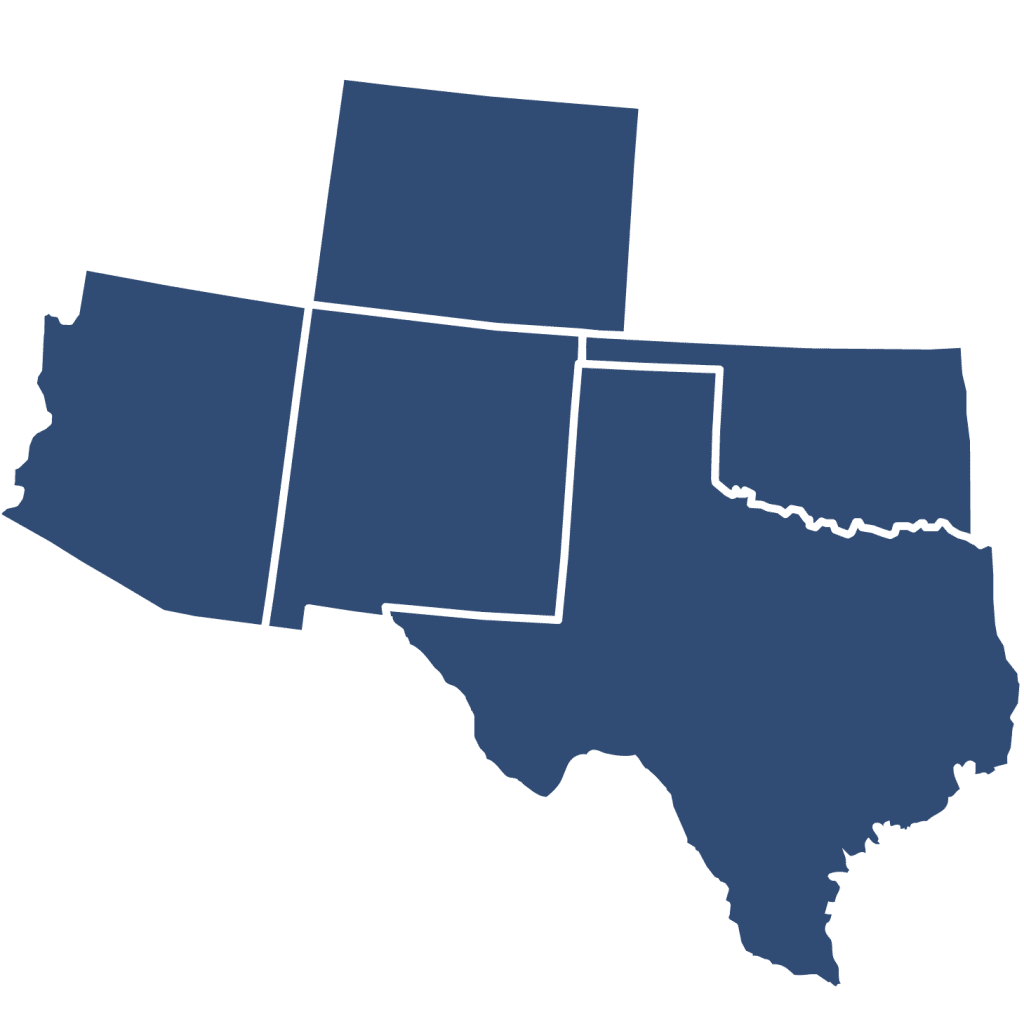

States where

we do business

States where we do business

- Connecticut

- Delaware

- Maine

- Maryland

- Massachusetts

- New Hampshire

- New Jersey

- New York

- Pennsylvania

- Rhode Island

- Vermont

- District of Columbia

- Florida

- Georgia

- North Carolina

- South Carolina

- Virginia

- Arizona

- Colorado

- New Mexico

- Oklahoma

- Texas

CROSS-SELL OPPORTUNITIES FOR SURPLUS LINES

Your homeowner clients may also require these products.

Personal Umbrella and Excess Liability Insurance

Offers additional liability coverage to pay for legal defense costs, settlements, and judgments when the limits of an underlying Auto, Homeowners, Watercraft, or Recreational Vehicle policy are reached.

Personal Articles Floater

Provides broader coverage than a standard Homeowners, Condo Owners, or Renters Insurance policy for various high-value personal items, like jewelry, fine art, designer handbags, antiques, and collectibles.

Does DeCotis Deliver? Hear From Our Agency Partners.

THE POWER OF CHOOSING DECOTIS

- In-House Binding Authority

- Deep Coastal Underwriting Expertise

- Responsive Support from Experienced Underwriters

- Customized Coverage Options

- Access to Multiple Lloyd’s Markets